What Is The Virtue With Regard To The Social Relation Of Taking And Spending Money?

A MESSAGE TO THE PUBLIC:

Each year the Trustees of the Social Security and Medicare trust funds report on the current and projected financial status of the two programs. The reports include extensive information most the electric current operations of these of import social insurance programs and conscientious analysis of their outlook. Nosotros believe the reports fully and fairly present the electric current and projected fiscal condition of the programs.

Social Security and Medicare both face long-term financing shortfalls nether currently scheduled benefits and financing. Both programs volition feel cost growth substantially in backlog of Gdp growth through the mid-2030s due to rapid population aging. Medicare also sees its share of Gross domestic product grow through the belatedly 2070s due to projected increases in the volum e and intensity of services provided.

The data and projections presented include the Trustees' all-time estimates of the effects of the COVID-19 pandemic and the 2020 recession, which were non reflected in concluding year's reports. The finances of both programs accept been significantly afflicted by the pandemic and the recession of 2020. Employment, earnings, interest rates, and GDP dropped substantially in the second calendar quarter of 2020 and are assumed to rise gradually thereafter toward total recovery by 2023, with the level of worker productivity and thus Gross domestic product assumed to exist permanently lowered past 1 percent even as they are projected to resume their pre-pandemic trajectories. In add-on, the Trustees also project elevated mortality rates related to the pandemic through 2023 (xv percent for those over age fifteen in 2021, declining to one percent by 2023) as well as reductions in immigration and childbearing in 2021-22 from the levels projected in the 2020 reports, with compensating increases a few years later. These alterations to near-term data and assumptions all significantly impact the outlook of the programs.

Given the unprecedented level of dubiety, the Trustees currently assume that the pandemic will have no net effect on the individual long-range ultimate assumptions. At this time, there is no consensus on what the lasting effects of the COVID-nineteen pandemic on the long-term feel might exist, if whatsoever. The Trustees will proceed to monitor developments and modify the projections in later reports.

Based on our best estimates, the 2021 reports show:

• The One-time-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivors benefits, will exist able to pay scheduled benefits on a timely basis until 2033, 1 yr earlier than reported terminal year. At that time, the fund'southward reserves will become depleted and continuing tax income will be sufficient to pay 76 per centum of scheduled benefits.

• The Disability Insurance (DI) Trust Fund, which pays disability benefits, will be able to pay scheduled benefits until 2057, 8 years earlier than in last year's report. At that fourth dimension, the fund's reserves volition go depleted and continuing tax income volition be sufficient to pay 91 percent of scheduled benefits.

• The OASI and DI funds are separate entities under police. The written report too presents information that combines the reserves of these two funds in order to illustrate the actuarial condition of the Social Security plan as a whole. The hypothetical combined OASI and DI funds would exist able to pay scheduled benefits on a timely basis until 2034, 1 year before than reported last year. At that time, the combined funds' reserves will become depleted and continuing tax income volition exist sufficient to pay 78 percent of scheduled benefits.

• The Hospital Insurance (Hullo) Trust Fund, or Medicare Part A, which helps pay for services such as inpatient hospital care, will be able to pay scheduled benefits until 2026, the same yr as reported terminal twelvemonth. At that time, the fund's reserves will get depleted and continuing total programme income volition be sufficient to pay 91 pct of full scheduled benefits.

• The Supplemental Medical Insurance (SMI) Trust Fund has two accounts: Part B, which helps pay for services such equally physician and outpatient hospital care, and Part D, which covers prescription drug benefits. SMI is adequately financed into the indefinite futurity considering current law provides financing from general revenues and beneficiary premiums each twelvemonth to meet the next year'south expected costs. Due to these funding provisions and the rapid growth of its costs, SMI volition place steadily increasing demands on both taxpayers and beneficiaries.

• The Trustees are including in the study for the fifth sequent year a conclusion of projected backlog general acquirement Medicare funding, as is required by law whenever annual tax and premium revenues of the combined Medicare funds will be below 55 per centum of projected combined annual outlays inside the side by side seven financial years. Under the law, two sequent such determinations, as is the instance over again this year, constitute a "Medicare funding warning." Under current constabulary and the Trustees' projections, such determinations and warnings will recur every year through the long-range project period.

Key Changes Since Terminal Yr

The long-range 75-year actuarial deficit of the combined OASI and DI trust funds increased from 3.21 to 3.54 pct of taxable payroll since the 2020 reports.1 Equally shown in Tabular array 1, this result was due to the combined effects of changes in methodology, legislation, regulation, economic, demographic, and programmatic assumptions, and recent observed feel. The following changes had significant furnishings.

• The post-obit long-range ultimate assumptions were changed:

• The total fertility rate was raised from 1.95 to 2.0 births per woman. This alter was combined with a change to the methodology for projecting fertility described below that commencement the supposition change.

• The unemployment rate was reduced from 5.0 percent to 4.v percent. This alter was combined with a change to the methodology for projecting the size of the labor force described below that offset the assumption modify.

• Changes were made to most-term economical and demographic assumptions reflecting the pandemic and the 2020 recession, resulting in lower payroll revenue enhancement income and lower revenue from income tax of benefits.

• Iii significant methodological changes were made:

• Future birth rates are now projected using a cohort-based (number of births in a adult female's lifetime) approach which meliorate captures a gradual shift towards childbearing at older ages.

• The model for projecting the size of the civilian labor forcefulness was updated to include data from the nigh recent completed economic cycle, thereby putting more than weight on the recent relationships among the various factors affecting labor force participation.

• A methodological alter was made to let for improved project of the initial benefit levels of retired workers by historic period.

• The 75-year valuation menstruation was changed from 2020-94 to 2021-95.

Tabular array ane: Change in the OASDI 75-Year Actuarial Remainder Since the 2020 Report, Based on Intermediate Assumptions

(every bit a percentage of taxable payroll)

| Particular | OASI | DI | OASDI |

|---|---|---|---|

| Actuarial residue shown in the 2020 Report | -three.fourteen | -.07 | -3.21 |

| Changes in actuarial balance due to changes in: | |||

| Legislation / Regulation | -.01 | .00 | -.01 |

| Valuation period | -.05 | -.01 | -.06 |

| Demographic data and assumptions | .06 | .01 | .07 |

| Economic information and assumptions | .00 | .00 | .00 |

| Disability data and assumptions | .00 | .00 | .00 |

| Methods and programmatic information | -.32 | -.01 | -.33 |

| Total change in actuarial balance | -.32 | -.01 | -.32 |

| Actuarial residuum shown in the 2021 Report | -iii.46 | -.08 | -3.54 |

Note: Totals do not necessarily equal the sums of components due to rounding.

The long-range 75-year actuarial arrears of the HI Trust Fund increased from 0.76 to 0.77 pct of taxable payroll. As shown in Table 2, this issue was due to the combined effects of changes in methodology, and economical, demographic, and programmatic assumptions, including the changes discussed to a higher place for OASDI:

• Three significant methodological changes exclusively affecting Medicare were made:

• Two improvements were fabricated to the methodology developed last year to incorporate time-to-death in the calculation of the demographic factors.two

• The population for each hospice time-to-death category was adjusted to reflect private wellness plan beneficiaries too as those enrolled in fee-for-service Medicare.

• The method for weighting the demographic factors was adapted to reflect reduced exposures for office-twelvemonth enrollees.

• Improvements were as well fabricated to better reflect the increasing number of cease-stage renal disease (ESRD) beneficiaries joining private health plans starting time in 2020.

Table two: Change in the HI 75-Year Actuarial Balance Since the 2020 Report, Based on Intermediate Assumptions

(equally a percentage of taxable payroll)

| Howdy | |

|---|---|

| Actuarial balance shown in the 2020 Report | -.76 |

| Changes in actuarial balance due to changes in: | |

| Valuation period | -.01 |

| Base guess | -.04 |

| Private health program assumptions | .03 |

| Infirmary assumptions | -.01 |

| Other provider assumptions | .00 |

| Methodological changes | .24 |

| COVID-19 spending assumptions | .00 |

| Other economical and demographic assumptions | -.22 |

| Total change in actuarial balance | -.01 |

| Actuarial residuum shown in the 2021 Written report | -.77 |

Conclusion

Lawmakers have many policy options that would reduce or eliminate the long-term financing shortfalls in Social Security and Medicare. Lawmakers should address these financial challenges as presently as possible. Taking action sooner rather than afterwards will permit consideration of a broader range of solutions and provide more fourth dimension to phase in changes and then that the public has acceptable time to set up.

By the Trustees:

Janet Yellen,

Secretarial assistant of the Treasury,

and Managing Trustee of the Trust Funds.

Xavier Becerra,

Secretary of Health and Human Services,

and Trustee.

Martin J. Walsh,

Secretary of Labor,

and Trustee.

Kilolo Kijakazi,

Acting Commissioner of Social Security,

and Trustee.

A SUMMARY OF THE 2021 Almanac SOCIAL SECURITY AND MEDICARE TRUST FUND REPORTS

This year's reports reflect the Trustees' estimates of the effects of the COVID-19 pandemic and the ensuing recession. These events have had pregnant effects on the finances of both the Social Security and Medicare programs. With the future class of the pandemic still uncertain, the Trustees will continue to monitor developments and modify the projections accordingly in future reports. Given this doubt, both reports assume that the pandemic will have no cyberspace outcome on the individual long-range ultimate assumptions used in the projections. Pandemic effects occur mainly in the curt range.

Employment, earnings, interest rates, and Gdp vicious essentially in the second quarter of 2020 and are assumed to rising gradually toward total recovery by 2023, with the level of worker productivity and thus GDP causeless to be permanently lowered by 1 per centum even equally they are projected to resume their pre-pandemic trajectories. The Trustees besides projection higher mortality related to COVID-nineteen and the pandemic through 2023 (15 percent higher for those aged xv and older in 2021, declining to i percent higher in 2023) and delays in births and immigration in the almost term.

In 2020, Social Security'south trust fund reserves were $ii.ix trillion at the twelvemonth'southward stop, having increased past $eleven billion. The Trustees projection that under the intermediate assumptions, the One-time-Age and Survivors Insurance (OASI) Trust Fund will be able to pay full benefits on a timely basis until 2033, a year before than in last year's Social Security report. The Disability Insurance (DI) Trust Fund is now projected to exist able to pay full benefits until 2057, 8 years earlier than indicated last year. The DI Trust Fund's reserve depletion engagement is very sensitive to changes in program cash flows and at that place is at present less revenue anticipated in the near term than in final year's report. The number of disabled-worker beneficiaries in current payment status connected to autumn in 2020, as it has since 2014.

The projected reserve depletion date for the combined OASI and DI funds is 2034, too a yr earlier than in last year'due south study.1 Over the 75-yr projection period, Social Security faces an actuarial arrears of 3.54 per centum of taxable payroll, increased from the 3.21 percent figure projected terminal year. The main reasons for the larger arrears are a mix of new program data and methodological improvements that worsen the projected arrears past increasing expected benefit costs and lowering anticipated revenue from the taxation of benefits. The change in the valuation menstruum—the inclusion of 2095, a high-arrears year—and lower short-range interest rates are additional contributing factors. The actuarial arrears equals 1.2 percentage of gross domestic production (GDP) through 2095.

Reserves in Medicare's Hospital Insurance (HI) Trust Fund decreased by $lx billion to a total of $134 billion at the end of 2020. This substantial decrease was due to an expansion of the Medicare Accelerated and Advance Payments (AAP) Programme during the COVID-19 public health emergency period, and was only partially start by spending reductions during the pandemic. These payments will be repaid in 2021 and 2022; thus, the increased accelerated and accelerate payments touch the timing of expenditures during 2020 through 2022, but not the total toll. The financial condition of the Hullo Trust Fund has non appreciably changed and the Trustees project that it will be able to pay full benefits until 2026, unchanged from last year's Medicare report. HI income is projected to be lower than final yr's estimates due to lower payroll tax revenues while HI expenditures are also expected to be lower because of smaller projected provider payment updates and improvements in the projection methodology. For the 75-twelvemonth projection menstruation, the Hi actuarial deficit has increased to 0.77 percent of payroll from 0.76 pct in final year's report, and is equivalent to 0.3 pct of Gross domestic product through 2095.

The Supplementary Medical Insurance (SMI) Trust Fund held $143 billion in assets at the cease of 2020. Parts B and D are expected to be fairly financed over the side by side ten years and beyond because income from premiums and general revenue are reset each year to cover expected costs and ensure an adequate reserve for Part B contingencies.

What Are the Trust Funds? Congress established trust funds managed past the Secretarial assistant of the Treasury to business relationship for Social Security and Medicare income and disbursements. The Treasury credits Social Security and Medicare taxes, premiums, and other income to the funds. There are iv separate trust funds. For Social Security, the OASI Trust Fund pays retirement and survivors benefits and the DI Trust Fund pays inability benefits. For Medicare, the Hi Trust Fund pays for Office A inpatient infirmary and related intendance. The SMI Trust Fund comprises 2 separate accounts: Function B, which pays for physician and outpatient services, and Part D, which covers prescription drug benefits.

The only disbursements permitted from the funds are do good payments and authoritative expenses. Federal law requires that all excess funds be invested in interest-bearing securities backed by the full faith and credit of the United States. The Section of the Treasury currently invests all program revenues in special non-marketable securities of the U.S. Regime which earn interest equal to rates on marketable securities with durations defined in constabulary. The balances in the trust funds, which represent the accumulated value, including interest, of all prior program annual surpluses and deficits, provide automatic authority to pay benefits.

Who Are the Trustees? There are six Trustees, four of whom serve past virtue of their positions in the Federal Authorities: the Secretary of the Treasury, the Secretary of Labor, the Secretary of Wellness and Homo Services, and the Commissioner of Social Security. The other 2 Trustees are public representatives appointed by the President, subject to confirmation by the Senate. The two Public Trustee positions take been vacant since July 2015.

How Are Social Security and Medicare Financed? For OASDI and HI, the major source of financing is payroll taxes on earnings paid by employees and their employers. Self-employed workers pay the equivalent of the combined employer and employee tax rates. During 2020, an estimated 174.viii one thousand thousand people had earnings covered by Social Security and paid payroll taxes; for Medicare the corresponding figure was 178.9 meg. Current police force establishes payroll tax rates for OASDI, which employ to earnings up to an almanac maximum ($142,800 in 2021) that ordinarily increases with the growth in the nationwide boilerplate wage. In dissimilarity to OASDI, covered workers pay Howdy taxes on total earnings. The scheduled payroll revenue enhancement rates (in percentage) for 2021 are shown in Table 1.

Table 1: 2021 PAYROLL TAX RATES

(In percent)

| OASI | DI | OASDI | HI | Total | |

|---|---|---|---|---|---|

| Employees | 5.thirty | 0.ninety | vi.20 | 1.45 | seven.65 |

| Employers | v.xxx | 0.90 | 6.20 | 1.45 | seven.65 |

| Combined total | ten.60 | i.80 | 12.forty | two.90 | xv.thirty |

At that place is an additional HI revenue enhancement equal to 0.ix percent of earnings over $200,000 for individual tax return filers, and on earnings over $250,000 for joint return filers.

Taxation of Social Security benefits is another source of income for the Social Security and Medicare trust funds. Beneficiaries with incomes above $25,000 for individuals (or $32,000 for married couples filing jointly) pay income taxes on up to 50 percent of their benefits, with the revenues going to the OASDI trust funds. This income from tax of benefits made up near iv percent of Social Security's income in 2020. Those with incomes higher up $34,000 (or $44,000 for married couples filing jointly) pay income taxes on up to 85 per centum of benefits, with the boosted revenues going to the HI Trust Fund. This income from tax of benefits represented nearly 8 percent of HI Trust Fund income in 2020.

The trust funds also receive income from interest on their accumulated reserves, which are invested in U.Southward. Government securities. In 2020, interest income made up vii percent of total income to the OASDI trust funds, 1 percent for Hullo, and less than 1 percentage for SMI.

Payments from the General Fund financed about 79 percent of SMI Part B and Part D costs in 2020. These payments were higher than usual due to a provision of the Standing Appropriations Act, 2021 and Other Extensions Act, which required a transfer to Part B for the outstanding balance of the Accelerated and Accelerate Payments Program and will exist repaid in 2021 and 2022. Most of the remaining SMI costs were covered by monthly premiums charged to enrollees, or in the case of low-income beneficiaries, paid on their behalf by Medicaid for Part B and Medicare for Part D. Function B and Office D premium amounts are adamant by methods defined in law and increase as the estimated costs of those programs rise.

In 2021, the Part B standard monthly premium is $148.fifty. There are also income-related premium surcharges for Role B beneficiaries whose modified adjusted gross income exceeds a specified threshold. In 2021, the threshold is $88,000 for individual taxation return filers and $176,000 for joint return filers. Income-related premiums range from $59.40 to $356.xl per month in 2021.

In 2021, the Part D "base of operations monthly premium" is $33.06. Actual premium amounts charged to Office D beneficiaries depend on the specific programme they have selected and are projected to average around $32 for standard coverage in 2021. Role D enrollees with incomes exceeding the thresholds established for Office B must pay income-related monthly adjustment amounts in improver to their normal plan premium. For 2021, the adjustments range from $12.xxx to $77.x per month. Role D also receives payments from States that partially recoup for the Federal assumption of Medicaid responsibilities for prescription drug costs for individuals eligible for both Medicare and Medicaid. In 2020, State payments covered about 11 percentage of Part D costs.

What Were the Trust Fund Operations in 2020? At the end of 2020, 55.2 million people received OASI benefits, nine.half dozen million received DI benefits, and 62.6 million were covered under Medicare. A summary of the trust fund operations is shown below (Tabular array ii). The OASI, DI, and SMI Trust Fund reserves increased in 2020; Howdy Trust Fund reserves declined.

Table two: TRUST FUND OPERATIONS, 2020

(in billions)

| OASI | DI | How-do-you-do | SMI | |

|---|---|---|---|---|

| Reserves (terminate of 2019) | $two,804.3 | $93.i | $194.vi | $108.viii |

| Income during 2020 | 968.3 | 149.vii | 341.7 | 558.1 |

| Toll during 2020 | 961.0 | 146.3 | 402.ii | 523.6 |

| Net change in Reserves | seven.4 | 3.5 | -60.iv | 34.5 |

| Reserves (stop of 2020) | two,811.7 | 96.half-dozen | 134.one | 143.3 |

Note: Totals practice not necessarily equal the sums of rounded components.

Tabular array 3 shows payments, by category, from each trust fund in 2020.

Table 3: Program Cost, 2020

(in billions)

| Category | OASI | DI | HI | SMI |

|---|---|---|---|---|

| Benefit payments | $952.iv | $143.half dozen | $397.seven | $518.7 |

| Railroad Retirement financial interchange | iv.8 | 0.1 | — | — |

| Authoritative expenses | 3.7 | two.six | 4.v | 5.0 |

| Total | 961.0 | 146.3 | 402.2 | 523.6 |

Notation: Totals do not necessarily equal the sums of rounded components.

Trust fund income, by source, in 2020 is shown in Table iv.

Table four: Plan INCOME, 2020

(in billions)

| Source | OASI | DI | Hi | SMI |

|---|---|---|---|---|

| Payroll taxes | $856.0 | $145.3 | $303.3 | — |

| Taxes on OASDI benefits | 39.0 | 1.7 | 26.9 | — |

| Interest earnings | 73.3 | 2.8 | 3.five | $1.8 |

| Full general Fund reimbursements | a | a | i.four | 29.half-dozen |

| General revenues | — | — | — | 384.1 |

| Beneficiary premiums | — | — | four.0 | 127.0 |

| Transfers from States | — | — | — | 11.6 |

| Other | a | — | 2.6 | four.0 |

| Total | 968.three | 149.7 | 341.7 | 558.ane |

Annotation: Totals practice not necessarily equal the sums of rounded components.

a Less than $50 million.

In 2020, Social Security'southward total income exceeded total cost past $11 billion, but when interest received on trust fund asset reserves is excluded from programme income, there was a deficit of $65 billion. The Trustees project that total cost will exceed total income (including interest) beginning in 2021 and in all years thereafter.

In 2020, the HI Trust Fund's total income ($342 billion), including $three billion of interest income (Tabular array 4), roughshod considerably short of plan expenditures ($402 billion). With the expected repayment of contempo increases in accelerated and accelerate payments during the COVID-19 pandemic, the Trustees anticipate a smaller HI deficit in 2021 followed past a small surplus in 2022. HI deficits are projected in all years after 2022, with reserves depleting in 2026. For SMI, general revenues, which are set prospectively based on projected costs, are the largest source of income.

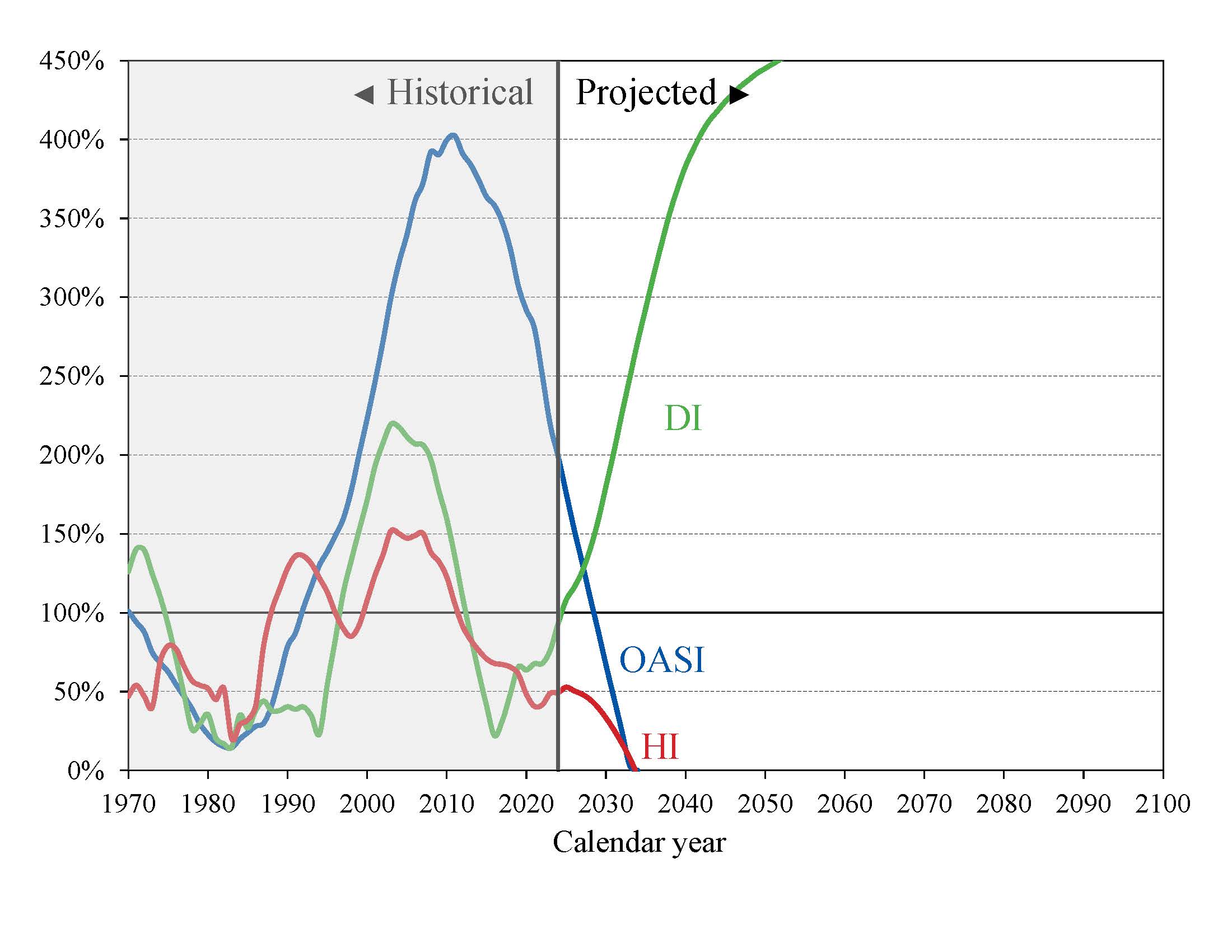

What Is the Outlook for Short-Term Trust Fund Adequacy? The Trustees Reports measure the short-range adequacy of the OASI, DI, and Hi Trust Funds past comparing fund asset reserves at the start of a yr to projected costs for the ensuing year (the "trust fund ratio"). A trust fund ratio of 100 percent or more—that is, asset reserves at to the lowest degree equal to projected cost for the yr—or reaching 100 percentage within 5 years is a proficient indicator of a fund's brusque-range adequacy. That level of projected reserves for whatsoever twelvemonth suggests that even if toll exceeds income, the trust fund reserves, combined with annual tax revenues, would be sufficient to pay full benefits for several years. Chart A shows the trust fund ratios through 2060 under the intermediate assumptions.

Chart A—OASI, DI, and HI Trust Fund Ratios

[Asset reserves as a per centum of annual cost]

By this measure, neither the OASI Trust Fund nor the DI Trust Fund is financially acceptable throughout the curt-range period (2021-30). The OASI Trust Fund fails the short-range test considering its trust fund ratio is projected to refuse from 280 percent at the beginning of 2021 to 85 percent at the starting time of 2030. The DI Trust Fund ratio was 66 percent at the beginning of 2021 and is not projected to attain 100 percent within v years.

The HI Trust Fund also does not come across the curt-range test of financial capability; its trust fund ratio was 39 percent at the outset of 2021 based on the year's anticipated expenditures, and the projected ratio does not rise to 100 pct within 5 years. Projected HI Trust Fund nugget reserves become fully depleted in 2026.

The Trustees apply a less stringent annual "contingency reserve" test to SMI Office B asset reserves because (1) the financing for that account is ready each twelvemonth to run into expected costs, and (ii) the overwhelming portion of the financing for that business relationship consists of general revenue transfers and beneficiary premiums, which were 74 percentage and 25 pct of total Part B income in agenda yr 2020. Part D premiums paid by enrollees and the required amount of general revenue financing are determined each twelvemonth. Moreover, flexible appropriation authority established by lawmakers for Role D allows additional general revenue transfers if costs are college than anticipated, limiting the need for a contingency reserve in that account.

What Are Fundamental Dates in OASI, DI, and HI Financing? The 2021 reports project that the HI Trust Fund will be depleted in 5 years and the OASI Trust Fund in 12 years; the predictable depletion yr for the DI Trust Fund is now 2057. Table 5 shows key dates for the 3 trust funds besides every bit for the combined OASDI trust funds. 2

Table five. Central DATES FOR THE TRUST FUNDS

| OASI | DI | OASDI | HI | |

|---|---|---|---|---|

| First year cost exceeds income excluding interesta | 2010 | 2040 | 2010 | 2008 |

| First twelvemonth toll exceeds total incomea | 2021 | 2045 | 2021 | 2023 |

| Year trust funds are depleted | 2033 | 2057 | 2034 | 2026 |

a Dates signal the get-go year a condition is projected to occur and to persist annually thereafter through 2095.

The Trustees project that DI Trust Fund reserves will increase through 2044 before failing annually until they are fully depleted in 2057. At that time, program income would exist sufficient to pay 91 percent of scheduled benefits, and 92 percent by 2095.

The OASI Trust Fund, when considered separately, has a projected reserve depletion engagement of 2033, a year earlier than in final year's study. At that time, 76 percent of scheduled OASI benefits would exist payable, declining to 72 percent in 2095.

The combined OASI and DI Trust Fund reserves have a projected depletion date of 2034, a year earlier than in last year'southward written report. Subsequently the depletion of reserves, standing revenue enhancement income would exist sufficient to pay 78 percent of scheduled benefits in 2034, and 74 pct by 2095.

The combined OASI and DI Trust Fund reserves are projected to decrease in 2021 because total cost ($1,151 billion) is expected to exceed total income ($one,074 billion). The Trustees project that OASDI total cost will exceed full income each yr throughout the remainder of the 75-year project period. Consequently, starting this year, internet redemptions of trust fund asset reserves with Full general Fund payments will be required to pay scheduled benefits until projected depletion of these reserves in 2034, a year earlier than in terminal year's written report.

The projected HI Trust Fund depletion engagement is 2026, the same year as reported final year. Under current police, scheduled HI tax and premium income would be sufficient to pay 91 percent of estimated Howdy cost after trust fund depletion in 2026, declining to 78 percent by 2045, and so gradually increasing to 91 percentage by 2095. The Medicare report projects a decrease in Hullo Trust Fund asset reserves in 2021 as total cost ($345 billion) is expected to exceed full income ($334 billion). With the predictable repayment of recent increases in accelerated and advance payments during the COVID-19 pandemic, the Trustees wait a small surplus in 2022, after which almanac Hi toll exceeds program income throughout the long-range projection period.

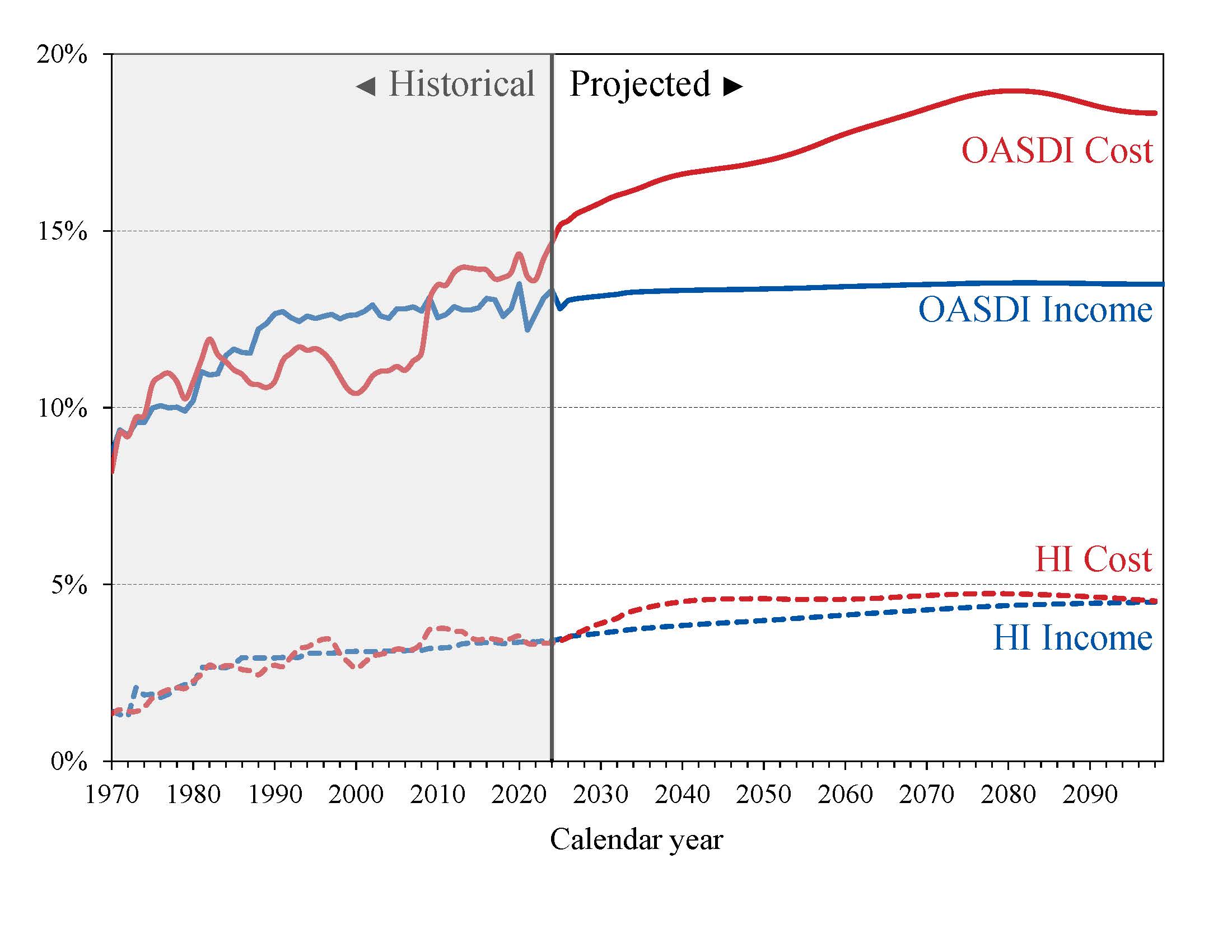

What is the Outlook for Future Social Security and Medicare Hullo Costs and Income in Relation to Taxable Earnings? Because the primary source of income for OASDI and HI is the payroll tax, it is informative to express the programs' incomes and costs as percentages of taxable payroll—that is, of the base of worker earnings taxed to back up each plan (Nautical chart B).

Nautical chart B—OASDI and HI Income and Cost as Percentages

of Their Respective Taxable Payrolls

It is important to understand that the two programs accept unlike taxable payrolls. HI taxable payroll is about 25 per centum larger than that of OASDI considering the Hello payroll tax is imposed on all covered earnings while OASDI taxes apply only to earnings upward to a maximum ($142,800 in 2021), which ordinarily is adjusted each year. Thus, the percentages in Chart B are comparable within each program, simply not across programs.

Both the OASDI and HI annual cost rates ascent over the long run from their 2020 levels (14.37 and 3.52 percent). Projected Social Security cost grows to 18.38 percent of taxable payroll for 2078, and then decreases to 17.70 percent in 2095. The projected Medicare Hullo cost rate rises to four.92 percent of taxable payroll in 2045, and thereafter remains at virtually that level, somewhen declining slightly to 4.81 pct in 2095.

The OASDI and HI income rates in Chart B include payroll taxes and taxes on OASDI benefits, just non interest payments. The projected OASDI income rate is stable at about thirteen percent throughout the long-range period. The HI income rate rises gradually from 3.37 percent in 2020 to iv.40 percentage in 2095 primarily due to the college payroll tax rates for high earners that began in 2013. Individual tax render filers with earnings above $200,000, and joint return filers with earnings higher up $250,000, pay an additional 0.ix percent taxation on earnings above these earnings thresholds. An increasing fraction of all earnings will exist subject field to the higher tax rate over time considering the thresholds are not indexed. By 2095, an estimated 80 per centum of workers would pay the higher rate.

What is the Long-Range Actuarial Balance of the OASI, DI, and HI Trust Funds? Another way to view the outlook for payroll tax-financed trust funds (OASI, DI, and How-do-you-do) is to consider their actuarial balances for the 75-yr valuation period. The actuarial residue measure includes the trust fund asset reserves at the start of the period, an ending fund residuum equal to the 76th year's costs, and projected costs and income during the valuation period, all expressed equally a pct of taxable payroll for the 75-year project menses. The actuarial balance is the difference betwixt the summarized income rate and the summarized price charge per unit every bit a percentage of taxable payroll over the valuation menses. A negative actuarial balance is an actuarial deficit. Note that actuarial residuum is not an informative concept for the SMI programme considering Federal law sets premium increases and general revenue transfers at the levels necessary to bring SMI into annual balance.

The actuarial arrears represents the boilerplate amount of change in income or cost that is needed throughout the valuation catamenia in order to attain actuarial balance. The actuarial balance equals zero if price for the period can be met for the menstruation every bit a whole and trust fund asset reserves at the stop of the menses are equal to the post-obit year's cost. The OASI, DI, and How-do-you-do Trust Funds all have long-range actuarial deficits under the intermediate assumptions, as shown in Table vi.

For the combined OASI and DI Trust Funds, the annual deficit, expressed as the difference between the cost rate and income rate for a particular year, was 0.85 percent of taxable payroll in 2020. Compared with final year'southward study, the Trustees project larger annual deficits for Social Security from 2021 through 2090, and and then smaller for 2091 through 2095. For the full 75-year project flow, the annual deficits average 0.23 percentage indicate greater in this year'due south report. Relatively small changes in near-term projections reflect the assumed recovery path from the COVID-19 pandemic and 2020 recession. The comparatively larger deficits projected in later on years in this yr'south report are mainly due to changes in the methodology and assumptions used to projection fertility rates. For 2095, the projected annual deficit is 4.34 percent of payroll, compared to 4.55 percent in last year's report.

Tabular array half-dozen. LONG-RANGE ACTUARIAL Arrears OF THE OASI, DI, AND Howdy TRUST FUNDS

[Pct of taxable payroll]

| OASI | DI | OASDI | HI | |

|---|---|---|---|---|

| Actuarial deficit | 3.46 | 0.08 | iii.54 | 0.77 |

Notation: Totals do not necessarily equal the sums of rounded components.

Projected almanac deficits for the combined OASI and DI programs gradually increase from 1.81 percent of taxable payroll in 2021 to 4.98 pct in 2078, and so decline to 4.34 percent of taxable payroll in 2095 (Chart B). The relatively large variation in annual deficits indicates that a single revenue enhancement rate increase for all years starting in 2021 sufficient to achieve actuarial balance would issue in large almanac surpluses early on in the period followed by increasing deficits in afterwards years. Sustainable solvency would require payroll tax rate increases or benefit reductions, or a combination thereof, past the end of the period that are essentially larger than those needed on average for this report'southward long-range period (2021-95).

In 2020, the How-do-you-do annual arrears was 0.15 percent of taxable payroll, and is expected to rise to 0.26 per centum in 2021. Projected annual deficits subsequently increase gradually to 1.06 pct of taxable payroll in 2045, earlier failing to 0.42 percent in 2095. The projected Hello cost rates in this year's Medicare report are very similar to those from the 2020 report. The Trustees wait annual HI deficits to increment every bit cost rates grow faster than income rates. The cost rate increases primarily due to rising per casher spending and the aging of the baby boom population. Throughout the long-range menstruation, cost rate growth is constrained by the productivity reductions in provider payments, and income rates continue to increase as a larger share of earnings becomes subject to the additional 0.nine percent payroll taxation and a larger share of Social Security benefits becomes subject area to income tax that is credited to the HI Trust Fund.

The fiscal outlooks for both OASDI and Howdy depend on a number of demographic and economical assumptions. Nevertheless, the actuarial deficit in each of these programs is large enough that averting trust fund depletion under electric current-law financing is extremely unlikely. An analysis that allows plausible random variations around the intermediate assumptions employed in the report indicates that OASDI trust fund depletion is highly probable (denoted by a 95-percent confidence interval) by 2041.

How Has the Financial Outlook for Social Security and Medicare Changed Since Last Year? The COVID-nineteen pandemic and 2020 recession have had significant effects on the brusque-range finances of both programs. Employment, earnings, interest rates, and Gdp dropped substantially in the 2nd quarter of 2020 and are causeless to ascension gradually toward full recovery by 2023, with the level of worker productivity and thus GDP permanently lowered by one percent. In addition, the pandemic and recession are causeless to lead to elevated bloodshed rates during the 2020-2023 menstruation and delays in births and immigration in the well-nigh term. Taken together, these data and assumptions cause the projected reserve depletion appointment for the combined OASI and DI Trust Funds to move from 2035 to 2034. These changes also consequence in a small but significant reduction in the actuarial residue for OASDI. For Medicare, there accept been notable impacts on short-term financing and spending patterns, but these are expected to play out by 2024 and the Trustees project little event on the actuarial residuum of the Medicare trust funds. There is, however, an unusually large caste of uncertainty associated with the eventual effects of COVID-19 and time to come projections could change significantly as more information becomes available.

Under the intermediate assumptions, the combined OASDI trust funds have a projected 75-year actuarial deficit equal to 3.54 percent of taxable payroll, compared with the iii.21 percentage figure reported last year. The projected depletion engagement for the combined asset reserves is 2034, a year earlier than in last year's written report. Advancing the valuation catamenia by 1 yr to include 2095, a year with a large negative balance, alone increases the actuarial deficit by 0.06 percent of taxable payroll. The change in the valuation period, new program data, changes in law, improvements in the projection methodology, and revised assumptions combine to increase the actuarial deficit by 0.32 percent of taxable in this twelvemonth's written report. Nearly all the change in the actuarial balance for the combined OASDI trust funds is attributable to the OASI Trust Fund.

Medicare'southward Hi Trust Fund has a long-range actuarial deficit equal to 0.77 percent of taxable payroll under the intermediate assumptions, 0.01 percentage signal higher than reported terminal twelvemonth. The anticipated appointment of depletion of the HI Trust Fund remains 2026. Several factors contributed to the change in the actuarial arrears, virtually notably less income from payroll taxes and revenue enhancement of Social Security benefits due to the pandemic, offset past methodological improvements to the project model.

Due to the nature of the financing for both parts of SMI, each account is separately in financial balance under electric current law, as they were last year. The projected Function B costs (expressed every bit a share of Gross domestic product) in this twelvemonth's Medicare report are like to those in last year'south report. The Role D projections are lower than in final yr's report primarily because of higher direct and indirect remuneration and the greater enrollment shift from Prescription Drug Plans to Medicare Reward Prescription Drug Plans, which more than than offset the college gross drug prices in this year'south study. SMI spending was 2.three percent of GDP in 2020, and is expected to increase to 4.4 percent of Gdp in 2094, equally projected in last twelvemonth's report.

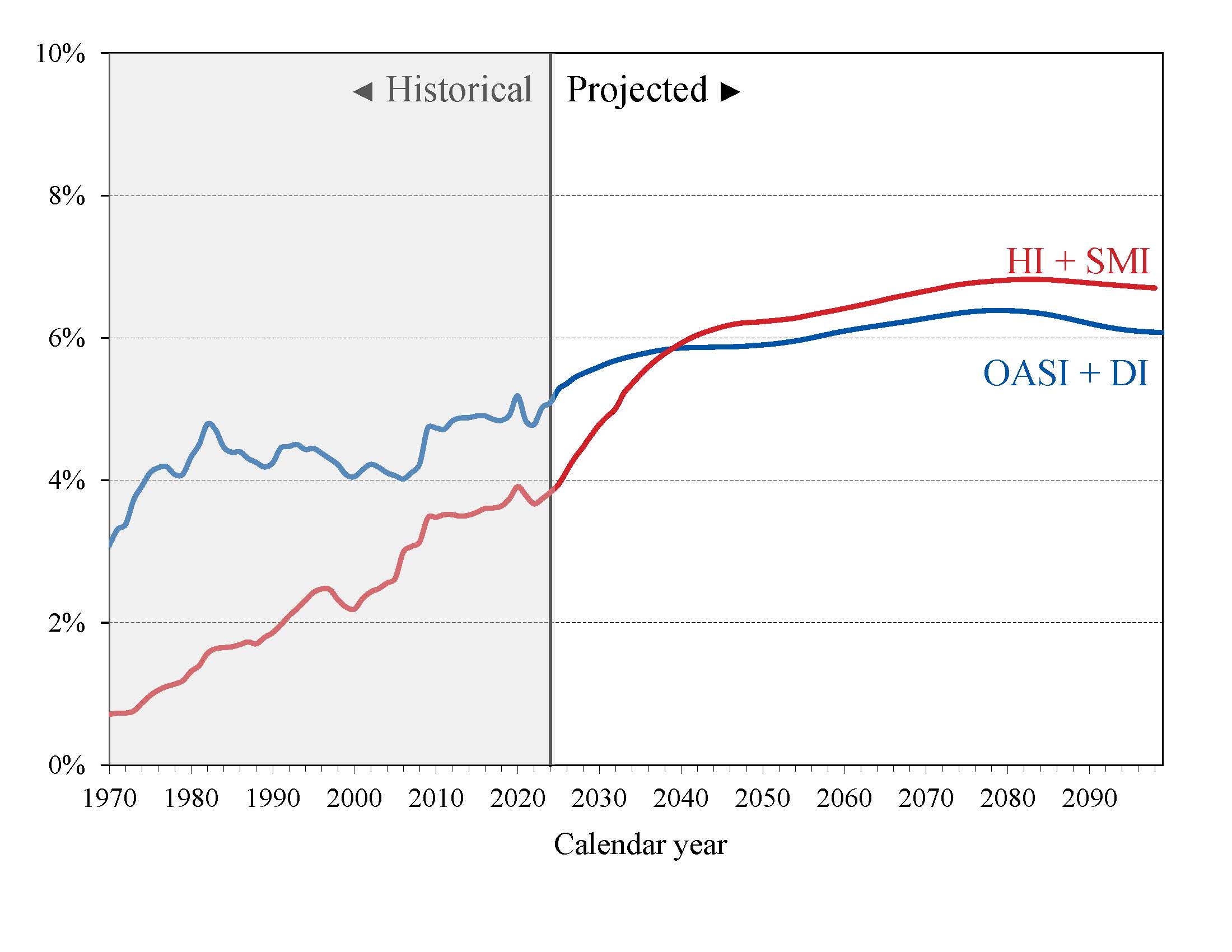

What Is the Outlook for Futurity Social Security and Medicare Costs in Relation to Gross domestic product? One instructive mode to view the projected costs of Social Security and Medicare is to compare the costs of scheduled benefits and administrative expenses for the programs with Gdp, the about oftentimes used measure of the total output of the U.S. economy (Chart C).

Nautical chart C—Social Security and Medicare Cost as a Percent of GDP

Under the intermediate assumptions employed in the reports, the costs of these programs as a percentage of GDP increase essentially through about 2035 because: (1) the number of beneficiaries rises rapidly as the infant-boom generation retires; and (2) the lower birth rates that take persisted since the baby smash crusade slower growth of employment and Gross domestic product.

Social Security's almanac price as a per centum of GDP is projected to increase from v.1 percent in 2021 to a peak of 6.2 percentage for 2077, and then decline to 5.ix percent by 2095. Under the intermediate assumptions, Medicare cost rises from 4.i percentage of GDP in 2021 to half-dozen.2 pct by 2045 due mainly to the rapid growth in the number of beneficiaries, and so increases further to 6.5 percentage by 2095. The growth in wellness care price per beneficiary becomes the larger factor afterward in the valuation catamenia, peculiarly in Part D.

In 2021, the combined cost of the Social Security and Medicare programs is estimated to equal nine.iii percent of Gross domestic product. The Trustees project an increase to xi.eight pct of GDP past 2035 and to 12.5 percent past 2095, with most of the increment owing to Medicare. Medicare's annual relative price is expected to rise gradually from fourscore percent of the cost of Social Security in 2021 to become the more than costly programme by 2040. During the concluding 25 years of the long-range menstruation, Medicare is, on boilerplate, about 7 per centum more costly than Social Security.

The projected costs for OASDI and Howdy depicted in Chart C and elsewhere in this summary reflect the full cost of scheduled electric current-law benefits without regard to whether the trust funds will have sufficient resources to meet these obligations. Electric current law precludes payment of any benefits across the corporeality that tin be financed past each of the trust funds, that is, from annual income and trust fund reserves. In years after trust fund reserve depletion, the amount of benefits that would exist payable is lower than shown because OASI, DI, and HI, by law, cannot borrow money or pay benefits that exceed the asset reserves in their trust funds. The projected Medicare costs assume realization of the full estimated savings specified by electric current law. As described in the Medicare Trustees Report, the projections for HI and SMI Part B depend significantly on the sustained effectiveness of various electric current-constabulary toll-saving measures, in particular, the lower increases in Medicare payment rates to well-nigh categories of health care providers.

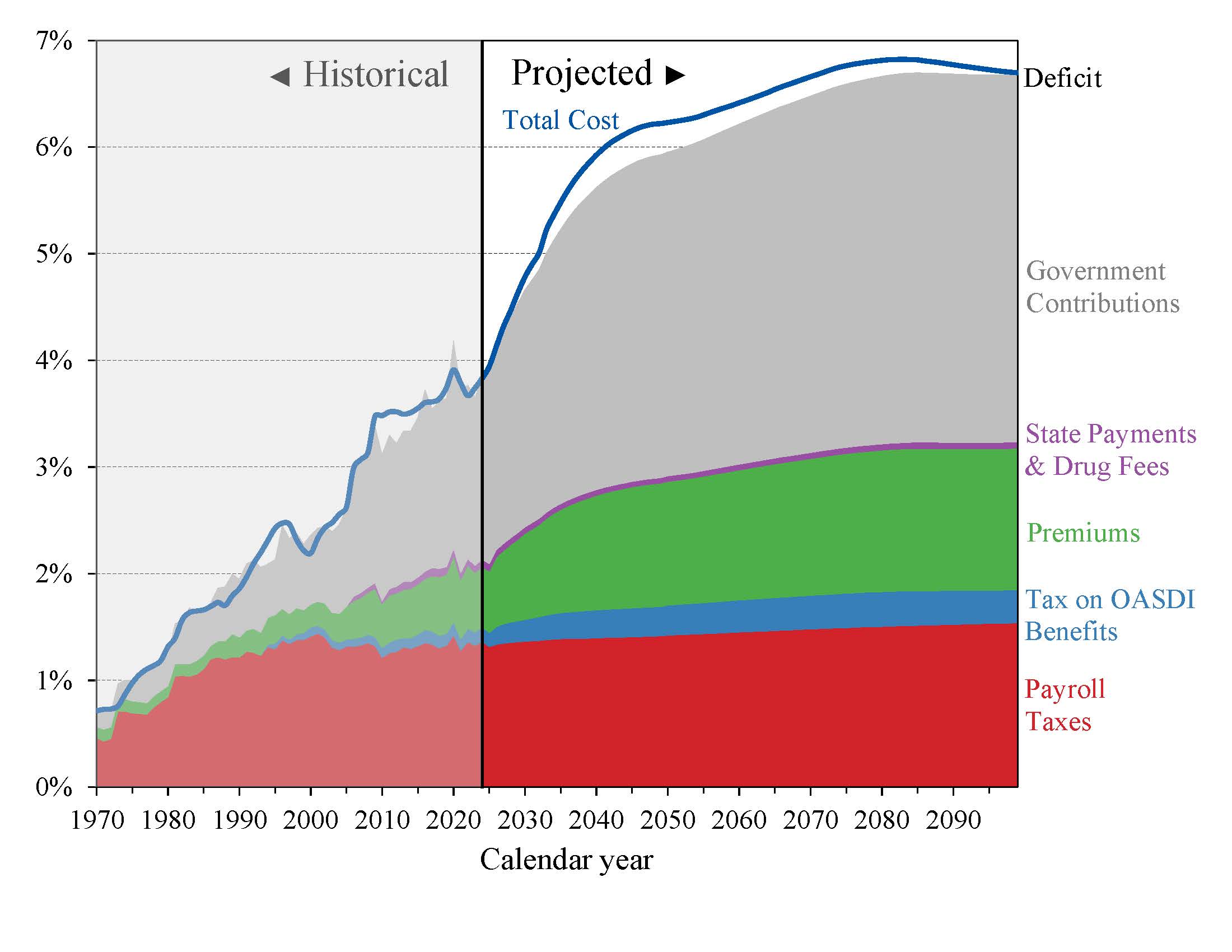

How Will Toll Growth in the Different Parts of Medicare Change the Sources of Plan Financing? Every bit Medicare price grows over time, general revenues and casher premiums will play an increasing role in financing the program. Chart D shows scheduled cost and non-interest acquirement sources under current law for HI and SMI combined as a percentage of Gdp. The total cost line is the same as displayed in Chart C and shows Medicare toll rise to 6.5 per centum of GDP past 2095.

Projected acquirement from payroll taxes and taxes on OASDI benefits credited to the Hullo Trust Fund increases from one.4 percentage of GDP in 2021 to 1.8 percentage in 2095 under electric current law, while projected full general acquirement transfers to the SMI Trust Fund increase from one.viii percent of Gross domestic product in 2021 to iii.one percent in 2095, and beneficiary premiums increase from 0.6 to one.2 per centum of GDP during the same flow. Thus, the share of total non-involvement Medicare income from taxes declines (from 37 percent to 29 percent) while the general revenue share rises (from 46 percent to 50 pct), as does the share of premiums (from fifteen percent to 19 pct). The distribution of financing changes in large part because costs for Function B and specially Part D—the Medicare components that are financed mainly from general revenues—increase at a faster rate than Part A price under the Trustees' projections. The projected annual HI financial deficits across 2035 are 0.4 to 0.v percent of Gross domestic product during 2036-60 and then gradually decline to 0.2 per centum of Gross domestic product by 2095. There is no provision under current law to finance that shortfall through general revenue transfers or whatever other acquirement source.

Chart D—Medicare Cost and Not-Interest Income by Source every bit a Percent of GDP

The constabulary requires that the Lath of Trustees determine each twelvemonth whether the annual difference betwixt programme toll and defended financing sources (the lesser four layers of Chart D) under current police exceeds 45 percentage of total Medicare cost in any of the first seven fiscal years of the 75-twelvemonth projection period. The Trustees Reports for 2006 through 2013, and in 2017 through 2020, independent a determination of "excess general revenue Medicare funding." Because the current projected difference is expected to exceed the 45 percent threshold in fiscal yr 2021, the Trustees are issuing a determination of projected backlog full general revenue Medicare funding in this yr's report, which is the fifth sequent twelvemonth with that determination. Because this decision has been made for at least two consecutive years, a "Medicare funding warning" is triggered, which requires that the President submit to Congress proposed legislation to respond to the alert within xv days after the submission of the Fiscal Year 2023 Budget. Congress is then required to consider the legislation on an expedited footing.

A Bulletin FROM THE PUBLIC TRUSTEES

Because the 2 Public Trustee positions are currently vacant, there is no Message from the Public Trustees for inclusion in the Summary of the 2021 Almanac Reports.

Source: https://www.ssa.gov/oact/TRSUM/

Posted by: johnsonrigh1962.blogspot.com

0 Response to "What Is The Virtue With Regard To The Social Relation Of Taking And Spending Money?"

Post a Comment